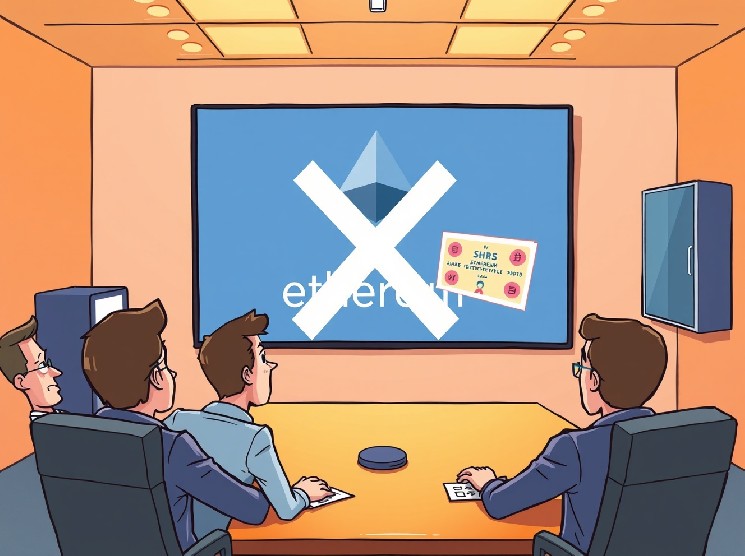

The world of cryptocurrency is dynamic, and even established players face unexpected hurdles. Recently, a significant development involving U.S. Bitcoin mining firm Bit Digital (BTBT) caught the attention of many. Their ambitious Bit Digital ETH proposal, aimed at funding Ethereum purchases through new share issuance, encountered an unforeseen setback. This article delves into what happened and what it means for the company and the broader crypto market. What Happened with the Bit Digital ETH Proposal? Bit Digital put forward a proposal to issue new shares. The goal was to generate capital specifically for acquiring more Ethereum (ETH). However, this Bit Digital ETH proposal did not pass at a recent shareholders’ meeting. The primary reason for this failure was a lack of quorum, meaning not enough shareholders were present or represented to make the vote legally binding. The proposal aimed to expand Bit Digital’s ETH holdings. A lack of quorum prevented the vote from proceeding. This isn’t a rejection of the idea itself, but a procedural delay. CryptoBriefing initially reported on this development, highlighting the procedural issue rather than a definitive ‘no’ from shareholders. Consequently, the company has rescheduled the vote, giving stakeholders another opportunity to weigh in on this important strategic move. Why is Bit Digital Pursuing an ETH Purchase? Bit Digital is primarily known as a Bitcoin mining operation. So, why the keen interest in Ethereum, and why issue new shares for it? The company already holds a substantial amount of ETH, currently exceeding 100,000 tokens. This indicates a clear strategic pivot or diversification effort. Investing in Ethereum can offer several benefits: Diversification: Spreading investments across different major cryptocurrencies can mitigate risk. Growth Potential: Ethereum, with its robust ecosystem and upcoming upgrades, holds significant growth prospects. Yield Opportunities: ETH can be staked, generating passive income, which could enhance the company’s revenue streams. The Bit Digital ETH proposal therefore represents a move to strengthen their position in the broader digital asset space, beyond just Bitcoin mining. This proactive approach aims to capitalize on Ethereum’s market potential and ecosystem development. What Does This Delay Mean for Bit Digital’s Strategy? A delay in passing the Bit Digital ETH proposal can have several implications, both short-term and long-term. In the short term, it means the company cannot immediately proceed with its planned ETH purchases using new capital. This could impact their ability to acquire ETH at current market prices, potentially missing out on favorable entry points. From a strategic standpoint, the delay might prompt the company to re-evaluate its communication with shareholders. Ensuring a quorum for the next vote will be crucial. This involves actively engaging shareholders and clearly articulating the benefits and rationale behind the proposal. The company’s existing ETH holdings remain unaffected, providing a stable base. However, the inability to expand these holdings as planned could slightly alter their short-term investment strategy and capital allocation plans. Looking Ahead: The Next Vote on the Bit Digital ETH Proposal Shareholders will have another chance to vote on the Bit Digital ETH proposal on September 17. This rescheduled meeting is a critical juncture for the company. It provides an opportunity to address any concerns shareholders might have and to ensure sufficient participation for a definitive outcome. For investors and market watchers, the upcoming vote will be a key event to monitor. A successful passage would signal Bit Digital’s commitment to its diversification strategy and potentially open doors for further ETH acquisitions. Conversely, another failure could lead to a re-evaluation of the company’s funding mechanisms or even its long-term asset strategy. The outcome will shed light on shareholder confidence in the company’s direction and its ability to execute on its strategic initiatives in the evolving crypto landscape. In Conclusion: Awaiting the Next Chapter The initial failure of the Bit Digital ETH proposal was a procedural hiccup, not a fundamental rejection. It underscores the importance of shareholder engagement and quorum requirements in corporate governance, even in the fast-paced crypto sector. With the next vote slated for September 17, all eyes will be on Bit Digital to see if they can successfully navigate this challenge and move forward with their plans to bolster their Ethereum holdings. The decision will undoubtedly influence their trajectory in the competitive world of digital asset mining and investment. Frequently Asked Questions (FAQs) Q1: What was the purpose of Bit Digital’s proposal? The proposal aimed to issue new shares to raise capital specifically for purchasing more Ethereum (ETH), thereby expanding Bit Digital’s cryptocurrency holdings beyond just Bitcoin. Q2: Why did the Bit Digital ETH proposal fail to pass initially? The proposal failed due to a lack of quorum at the shareholders’ meeting. This means not enough shareholders were present or represented to legally cast a vote on the matter. Q3: When is the next vote scheduled for the Bit Digital ETH proposal? The next vote on the Bit Digital ETH proposal is scheduled for September 17. Q4: How much Ethereum does Bit Digital currently hold? Bit Digital currently holds more than 100,000 ETH. Q5: What are the potential benefits of Bit Digital acquiring more ETH? Acquiring more ETH could offer Bit Digital benefits such as portfolio diversification, capitalizing on Ethereum’s growth potential, and exploring yield opportunities through staking. If you found this article insightful, consider sharing it with your network! Stay informed about the latest developments in the crypto space by following our updates on social media. Your shares help us reach more crypto enthusiasts and investors. To learn more about the latest crypto market trends, explore our article on key developments shaping Ethereum institutional adoption. Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

The Next Big Crypto IPO? Everything You Need to Know About Gemini's Stock Offering

2 hour ago

Mr. Wonderful' Now Focusing Only on BTC and ETH, Rejecting Other Coins

2 hour ago

The $1 Billion Move for Solana (SOL) Has Finally Arrived – Activity Seen in On-Chain Data

2 hour ago

Nepalese Protestors Should Permanently Embrace Bitchat as Well as Bitcoin and Other Freedom Tech

2 hour ago

CFTC Nominee Brian Quintenz tells all in Winklevoss twins fight

2 hour ago

$4.3B Bitcoin options expiry could open the door for a BTC rally to $120K

2 hour ago