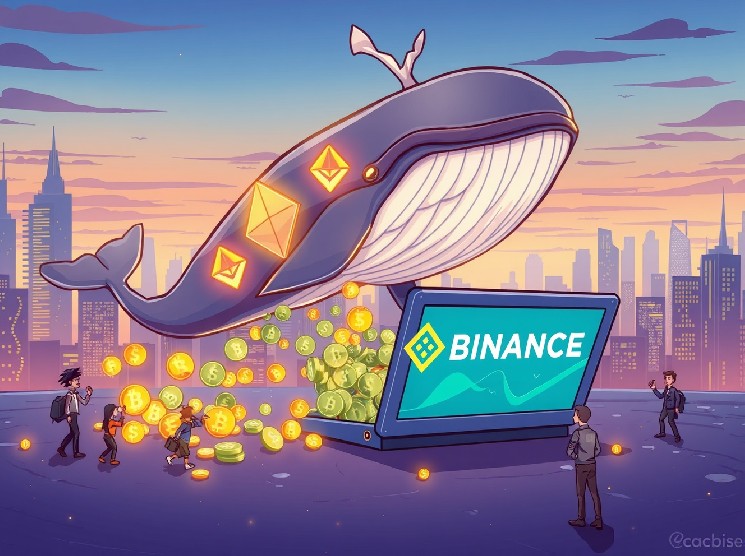

A remarkable event has just sent ripples through the crypto community: an ETH staking whale has made a colossal move, depositing 25,755 ETH—a staggering $117 million—onto the Binance exchange. This isn’t just a casual transaction; it’s a significant development that could signal major shifts for Ethereum holders and the broader market. What does such a massive transfer from an ETH staking whale truly mean, and how might it impact the future of ETH? What Does an ETH Staking Whale’s Massive Deposit Signify? When an entity known as an ETH staking whale moves such a substantial amount of digital assets, the crypto world takes notice. Specifically, this particular investor, who had previously unstaked their Ethereum 17 days ago, transferred 25,755 ETH, valued at an astonishing $117 million, to Binance. This information, brought to light by the reputable on-chain analyst EmberCN, immediately sparks questions about the investor’s intentions. The sheer scale of this deposit suggests a calculated move. If this ETH staking whale were to sell at current market prices, they would realize a significant profit of approximately $60.5 million. This kind of profit-taking is not uncommon, especially after a period of holding and staking, but the timing and magnitude often carry deeper implications for market dynamics. Understanding the Strategy Behind Such a Large ETH Staking Whale Move So, why would an ETH staking whale make such a dramatic move? There are several strategic possibilities that market watchers are currently contemplating: Profit Realization: The most straightforward explanation is simply cashing in on substantial gains. After unstaking their ETH 17 days prior, the investor might have decided it was an opportune moment to secure profits. Market Rebalancing: This whale might be preparing to reallocate funds into other cryptocurrencies or even stablecoins, diversifying their portfolio or anticipating shifts in other assets. Liquidity Provision: The funds could be intended for participation in decentralized finance (DeFi) protocols, such as providing liquidity on decentralized exchanges (DEXs) or lending platforms, where they can earn additional yield. Anticipating Volatility: Some whales move funds to exchanges when they expect increased market volatility, either to capitalize on price swings or to de-risk by converting to stablecoins. It’s crucial to remember that the assets were unstaked almost three weeks ago. This delay suggests a deliberate, pre-planned action rather than an impulsive decision, adding another layer of intrigue to the ETH staking whale‘s strategy. What Are the Potential Market Implications for Ethereum? The actions of an ETH staking whale can certainly send ripples through the market, influencing sentiment and potentially price action. While a $117 million deposit is significant, it’s important to put it into context relative to Binance’s vast trading volume and Ethereum’s overall market capitalization. However, even a perceived threat of a large sell-off can trigger reactions. For other investors, this event serves as a powerful reminder to stay informed about on-chain movements. Monitoring whale activity can offer valuable insights into potential market trends. It underscores the dynamic nature of the crypto market, where large holders can, at times, dictate short-term movements. Key Takeaways for Investors: Monitor ETH Price Action: Keep an eye on ETH’s performance in the coming days for any signs of increased selling pressure. Analyze Market Sentiment: Observe how the broader crypto community reacts to this news. Is there fear, uncertainty, or business as usual? Consider Your Own Strategy: Use such events as a prompt to review your investment goals and risk tolerance. The recent deposit by an ETH staking whale into Binance is more than just a large transaction; it’s a fascinating glimpse into the strategic decisions made by major players in the crypto space. Whether it signals profit-taking, portfolio rebalancing, or preparation for new ventures, such moves highlight the constant ebb and flow of capital in the digital asset ecosystem. While the immediate impact on ETH’s price remains to be seen, this event certainly reinforces the importance of vigilant market observation and understanding the potential influence of large holders. Frequently Asked Questions (FAQs) What is an ETH staking whale? An ETH staking whale is an individual or entity that holds and stakes a very large amount of Ethereum (ETH) tokens. Their substantial holdings give them significant influence over market dynamics due to the potential impact of their transactions. Why is this specific ETH deposit significant? The deposit of 25,755 ETH, valued at $117 million, is significant due to its sheer size. Such a large movement of assets by an ETH staking whale can indicate potential profit-taking, portfolio rebalancing, or other strategic moves that could influence market sentiment and ETH’s price. Will this cause ETH’s price to drop? While a large deposit to an exchange could suggest an intent to sell, potentially increasing selling pressure, it doesn’t automatically guarantee a price drop. The market’s overall liquidity and demand, as well as the whale’s actual actions (whether they sell, re-stake, or use for other purposes), will ultimately determine the impact. How can I track whale movements in the crypto market? You can track whale movements using on-chain analytics platforms and services. These tools monitor large transactions on blockchain networks and provide insights into the activities of major holders, often alerting users to significant deposits or withdrawals from exchanges. What does ‘unstaked’ mean in the context of Ethereum? When Ethereum is ‘staked’, it means it is locked up in a smart contract to support the network’s security and operations, earning rewards in return. ‘Unstaked’ means the ETH has been withdrawn from this staking contract and is now liquid, allowing the holder to move or sell it freely. Did this insight into the ETH staking whale‘s move spark your interest? Share this article with your fellow crypto enthusiasts on social media to keep the conversation going! To learn more about the latest Ethereum trends, explore our article on key developments shaping Ethereum price action. Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Solana open interest hits $16.6B as traders set SOL price target above $250

50 min ago

Ethena’s USDe and sUSDe Go Live on Avalanche in Major Cross-Chain Push

51 min ago

XRP spot ETFs were supposed to start trading today, got delayed

53 min ago

TON Strategy launches $250M buyback while shares drop 7.5%

55 min ago

HBAR Price Prediction Amid DTCC Listing and Archax Expansion — Is $0.50 Next?

59 min ago

Winklevoss Twins Call for $1 Million Bitcoin Price as Gemini Goes Public

1 hour ago