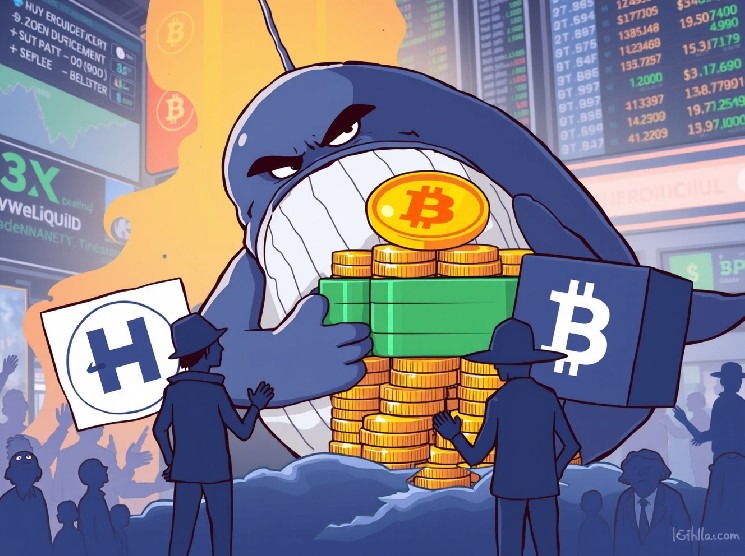

A staggering event has sent ripples through the crypto community, sparking intense speculation and concern. A mysterious Hyperliquid whale has reportedly moved an astonishing $326 million in USDC to Binance, raising eyebrows and fueling suspicions of insider trading. This massive stablecoin transfer isn’t just a large transaction; it’s a significant market signal that demands closer examination, especially for those keen on understanding market dynamics. What Triggered the Alarm Bells for This Hyperliquid Whale? The alarm was first sounded by on-chain analyst ai_9684xtpa, who meticulously tracked the movements of this colossal crypto entity. The data reveals that the Hyperliquid whale initially withdrew 36.41 million USDC from the Hyperliquid platform before consolidating a monumental 326 million USDC deposit onto Binance. This substantial movement of funds immediately drew attention from market observers. Such large transfers often precede significant market events or shifts in trading strategy, making them noteworthy. The sheer scale of the transaction alone is enough to warrant scrutiny. However, it’s the context surrounding the wallet’s previous activities that truly ignites the insider trading allegations, prompting a deeper look into the actions of this specific Hyperliquid whale. Unpacking the Insider Trading Suspicions The core of the controversy lies in the suspicion that this particular Hyperliquid whale may have profited from insider information. While specific details of the alleged insider trading are not publicly detailed by the analyst, the timing and magnitude of the deposits suggest a potential advantage. Insider trading in traditional markets involves using non-public information for personal gain. In the less regulated crypto space, such activities are harder to prove but can have profound impacts on market integrity and investor trust. The analyst’s observations imply a pattern of behavior indicative of privileged knowledge. Such actions undermine the principles of fair and transparent markets, which are crucial for crypto’s long-term adoption and investor confidence. Why is a Stablecoin Deposit to an Exchange So Significant? While many traders open futures positions directly on platforms like Hyperliquid, moving such a vast sum of stablecoins to a centralized exchange like Binance sends a different, potentially more powerful message. As the analyst noted, this move could be a more significant market signal than simply opening an on-chain futures position. Here’s why such a large deposit by a Hyperliquid whale is crucial: Preparation for Major Trading: Large stablecoin deposits often indicate an intention to engage in substantial buying or selling activity on the exchange. This could involve spot trading, entering new derivatives positions, or preparing for large-scale liquidations. Market Impact: A sudden influx of such capital can influence order books, especially for less liquid assets, potentially creating price volatility. Liquidity Management: The whale might be positioning funds for arbitrage opportunities, anticipating a major market move, or simply diversifying their stablecoin holdings across platforms for better liquidity management. This strategic maneuver by the Hyperliquid whale suggests a calculated move rather than a casual transfer, signaling potential future market actions. What Are the Broader Implications for the Crypto Market? The actions of a single, powerful entity, particularly a Hyperliquid whale, can send ripples across the entire cryptocurrency ecosystem. This event underscores several critical aspects of the market that demand attention: Transparency Challenges: While on-chain data provides unparalleled transparency into transactions, identifying the true identities behind large wallets remains a significant challenge. Regulatory Scrutiny: Incidents like this intensify calls for greater regulation and oversight in the crypto space, especially concerning market manipulation and insider trading. Investor Confidence: Suspicions of unfair practices can erode trust among retail investors, making them more hesitant to participate in certain platforms or the market as a whole. The crypto community watches closely, anticipating what moves this whale might make next on Binance, and what impact it could have on market stability. The massive $326 million USDC deposit by a suspected insider trading Hyperliquid whale to Binance is more than just a headline; it’s a stark reminder of the complexities and potential vulnerabilities within the decentralized finance landscape. While the ultimate purpose of the deposit remains shrouded in mystery, its significance as a market signal cannot be overstated. This event highlights the ongoing tension between on-chain transparency and the anonymity that often shields large players, urging continued vigilance and discussion about market integrity. Frequently Asked Questions (FAQs) Q1: What is a Hyperliquid whale? A “whale” in cryptocurrency refers to an individual or entity holding a very large amount of a specific cryptocurrency or assets on a particular platform, giving them significant influence over market movements. A Hyperliquid whale specifically holds substantial assets or trading volume on the Hyperliquid decentralized exchange. Q2: What is USDC? USDC (USD Coin) is a stablecoin pegged to the U.S. dollar, meaning its value is intended to remain stable at $1.00 USD. It is backed by reserves of U.S. dollar-denominated assets, providing a stable medium for transactions and value storage in the volatile crypto market. Q3: Why is depositing stablecoins to an exchange a significant market signal? Depositing a large amount of stablecoins like USDC to a centralized exchange often indicates an intention to buy other cryptocurrencies, enter large derivatives positions, or engage in significant trading activity. It suggests a strategic move to deploy capital, potentially influencing market prices. Q4: What are the implications of suspected insider trading in crypto? Suspected insider trading erodes investor trust, undermines market fairness, and can lead to significant price volatility. It often prompts calls for increased regulatory oversight and can harm the reputation of platforms involved, impacting the broader adoption of cryptocurrencies. Q5: Who is ai_9684xtpa? ai_9684xtpa is an on-chain analyst known for tracking and reporting significant cryptocurrency movements and market activities, often providing insights into large wallet behaviors and potential market trends. Stay informed about critical market movements and share this analysis with your network. Your engagement helps foster a more transparent and aware crypto community, contributing to a healthier ecosystem for everyone. To learn more about the latest crypto market trends, explore our article on key developments shaping cryptocurrency price action. Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

Ledger Taps 1inch dApp for Secure DeFi Trading with One-Click

1 hour ago

US stocks react to CPI inflation report – Dow jumps 350 points

1 hour ago

Trump Picks SEC Crypto Task Force’s Mike Selig to Run CFTC: Report

2 hour ago

Public Keys: DraftKings Gets Predictable, Canaan Turns Around and Zelle Likes Stables

2 hour ago

Custodia, Vantage Expand Pilot Into Live Tokenized Deposit Network for US Banks

2 hour ago

U.S. Inflation Data, Published Uninterrupted for 100 Years, May Not Be Released Next Month

2 hour ago