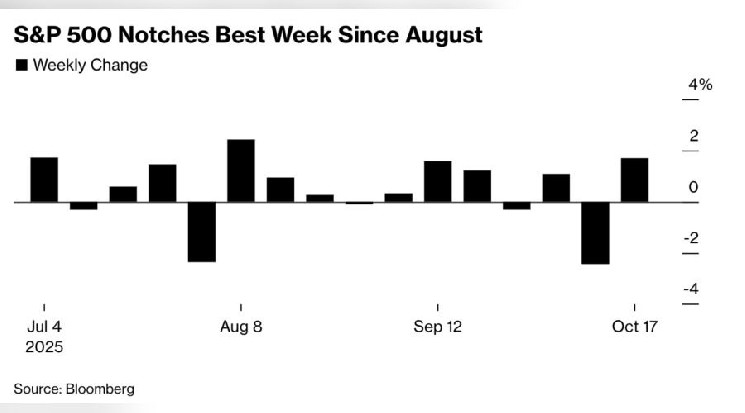

The current week in the financial markets has been particularly interesting, as the “Super FOMO rally” for Gold persisted, driving the price of the metal to above $4300. Other markets wobbled without any significant development, with S&P500 having locked in the range between $6500 and $6700. For the present moment, Gold makes an unstoppable upward move for around 2 months in a row without significant corrections, which is the absolute record for many years. As the “fear of missing out” attitude moves to the retail sector, as people are building in queues to buy and sell physical Gold around the globe, the peak of the rally might be achieved soon. However, it’s difficult to predict the exact points of reversal, as the bullish trend For the present moment, the main asset in the spotlight is Gold, which has made the unstoppable upward move for around 2 months in a row without significant corrections, which is the absolute record for many years. The “fear of missing out” attitude moves to the retail sector, as people are building in queues to buy and sell physical Gold around the globe. That might point to the potential peak of the rally to be achieved soon. However, it’s difficult to predict the exact points of reversal, as the bullish trend still persists. On Friday last week, the US president Donald Trump had softened the rethorics, stock indices have rebounded on Friday, sending S&P 500 to its best day since August. Gold and metals have corrected from peaks, displaying some relief for the “Super FOMO rally”. The government shutdown in the US still continues, which has put on hold some important economic publications, such as the US inflation, for example (the anticipated publication was on Oct 15th). The next date of the publication is scheduled Oct 24th. This week, traders will look forward to speeches of several FED’s members, and the expected US inflation on Friday. The expected crude oil stocks change will be published on Wednesday. In this review, we will focus on several trading opportunities, which might potentially unfold this week. JPM The JP Morgan stock is testing the dynamic support area, moving inside of the 14-day swing from the peak of 29-th of September, 2025. The downside move may reverse off the support zone, as the swing is already mature, and according to statistical studies, directional moves rarely last for more than 16 days for this instrument. If volatility in the market would bounce back and the relief in rethorics from Donald Trump will improve the sentiment, markets may exhale this week, with a focus on the financial sector, and strong names such as JP Morgan. The expected target area may be around $309-310. USDCAD USDCAD is moving inside of a rising wedge above the dynamic support zone and may resume the upswing this week, as the US dollar index may get support after softening rhetoric of Donald Trump. Yields of 30-year bonds of Canada have declined, but with less volatility than for the US treasuries. The weakness of Crude oil futures pressures CAD against the USD, and focuses traders on the long side of USDCAD in the near future. The position of the price of USDCAD is above 200-day moving average, which boosts the bullish momentum for this currency pair.

Galaxy Digital Says Helios a ‘Gold Rush,’ Reveals Q3 Revenue Beat and Client Growth

1 hour ago

Gov. Waller: U.S. Fed to 'Embrace Disruption,' Pitches 'Skinny' Master Account Idea

1 hour ago

October Ends Empty, Bitcoin (BTC) Still Can't Find Its Direction! Analyst: "These Levels Are Very Critical, Must Be Monitored Closely!

1 hour ago

Coinbase Sees TradFi Institutions Driving Crypto Derivatives Boom

1 hour ago

Evernorth to Go Public via Armada Merger

1 hour ago

Ethereum Core Veteran: Vitalik Buterin Has 'Complete Indirect Control’ Over Ecosystem

1 hour ago