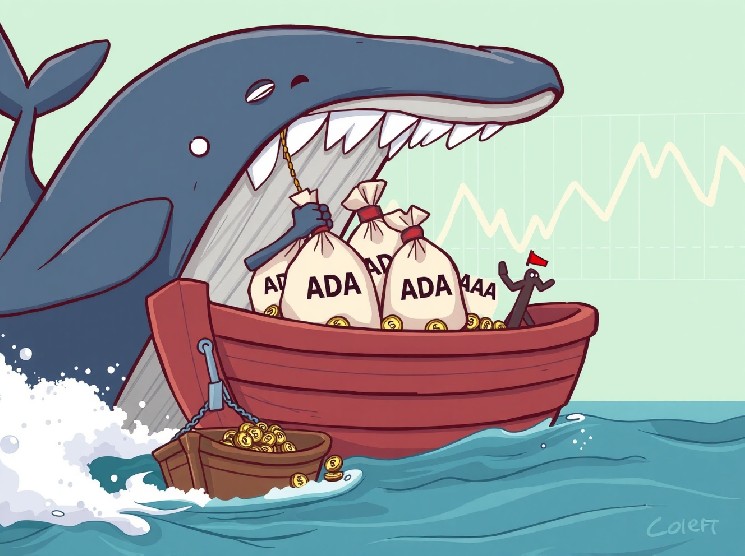

The cryptocurrency market is always buzzing with activity, and recently, all eyes have been on Cardano (ADA). A significant wave of ADA whale selling has captured the attention of investors and analysts alike, signaling potential shifts in market dynamics. Over the past two weeks, powerful “whale” addresses have offloaded a staggering 140 million ADA tokens, equating to approximately $120 million. This substantial movement, highlighted by prominent crypto analyst Ali Martinez, raises crucial questions about Cardano’s immediate future and the broader sentiment among large holders. What’s Behind This Surge in ADA Whale Selling? When such a large volume of a digital asset changes hands, especially from significant holders, it’s natural to wonder about the underlying causes. This recent ADA whale selling event could stem from various factors, reflecting complex market strategies or reactions to broader economic trends. Profit-Taking: Whales, by definition, hold vast amounts of cryptocurrency. They might be capitalizing on recent price increases or rebalancing their portfolios to lock in profits. Market Reallocation: Large investors often move funds between different assets. The ADA sold could be reallocated into other cryptocurrencies, stablecoins, or even traditional investments. Anticipation of Volatility: Some whales might foresee potential market corrections or increased volatility, prompting them to reduce their exposure to ADA. Understanding these motivations is key to interpreting the market’s pulse. However, it’s crucial to remember that whale movements alone do not dictate the entire market’s direction. The Immediate Impact of Significant ADA Whale Selling The immediate effect of such a large sell-off can be noticeable. Typically, a substantial increase in selling pressure can lead to a downward price movement or at least hinder upward momentum. For Cardano, this period of ADA whale selling has indeed coincided with market adjustments. However, the market is resilient. While large sales can create ripples, they don’t always signal a long-term decline. Instead, they often present opportunities for other investors. Retail investors and smaller institutions might see these dips as a chance to acquire ADA at a more favorable price, believing in Cardano’s long-term vision and technological advancements. It’s a dynamic interplay between supply and demand, where the actions of a few large players can influence, but not solely determine, the market’s trajectory. Therefore, observing how the broader market reacts to this influx of supply is essential. What Does This Mean for Cardano’s Future Amidst ADA Whale Selling? Cardano has a robust ecosystem and a dedicated community. The project continues to develop its smart contract capabilities, scalability solutions, and decentralized applications. Despite the recent ADA whale selling, the underlying fundamentals of the Cardano network remain strong. Investors should consider several aspects when evaluating the impact of whale activity: Project Development: Is Cardano continuing to hit its development milestones? New features and upgrades can bolster investor confidence. Community Support: A strong, engaged community often acts as a buffer against significant market shocks. Adoption Rates: Increasing real-world utility and adoption of the Cardano blockchain can offset selling pressure from large holders. While the short-term price action might be influenced by large sales, the long-term health of a cryptocurrency project largely depends on its utility, innovation, and community backing. Hence, keeping an eye on these core aspects is vital. The recent period of ADA whale selling, totaling $120 million over two weeks, is undoubtedly a notable event in the cryptocurrency space. It underscores the powerful influence that large holders can exert on market sentiment and price. However, it’s also a reminder that the crypto market is complex and driven by numerous factors beyond just whale movements. For investors, understanding these dynamics, conducting thorough research, and maintaining a long-term perspective are crucial. Cardano’s journey is far from over, and how it navigates these periods of significant capital movement will be a testament to its resilience and continued evolution. Staying informed about market trends and project developments will empower you to make more confident decisions in this ever-changing landscape. Frequently Asked Questions (FAQs) What is an ADA whale? An ADA whale is an individual or entity that holds a very large amount of Cardano (ADA) cryptocurrency. Their significant holdings mean their buying or selling actions can notably influence the market price and sentiment. Why do whales sell large amounts of cryptocurrency? Whales sell for various reasons, including taking profits after a price increase, rebalancing their investment portfolios, diversifying into other assets, or anticipating future market volatility or price drops. Does whale selling always mean the price will drop significantly? Not necessarily. While large sales can create downward pressure, the market’s overall liquidity, demand from other investors, and the project’s fundamental strength can absorb the selling pressure, preventing a drastic price fall. How can I track ADA whale activity? You can track whale activity using on-chain analytics platforms and cryptocurrency data aggregators. These tools monitor large transactions and provide insights into the movements of significant token holders. What should I do if I hold ADA and see whale selling? It’s important to avoid panic. Instead, conduct your own research into the reasons behind the selling, evaluate Cardano’s fundamentals, and consider your personal investment goals and risk tolerance. Long-term holders often ride out short-term fluctuations. Did this analysis help you understand the recent ADA whale selling and its implications? Share this article with your friends and fellow crypto enthusiasts on social media to spread awareness and spark further discussion! To learn more about the latest crypto market trends, explore our article on key developments shaping Cardano price action. Disclaimer: The information provided is not trading advice, Bitcoinworld.co.in holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.

ICB Network Partners with Tectum to Pioneer Zero-Fee PayFi Transfers in Web3

5 hour ago

Native Markets officially claims Hyperliquid's USDH stablecoin ticker

5 hour ago

Top catalysts for the crypto market this week

5 hour ago

Tether’s ‘hedge-and-expand’ US strategy puts Circle on defense in market shake-up, tests oversight versus privacy

5 hour ago

UFC Expands Web3 Partnership with Fightfi’s Fight.ID Platform

5 hour ago

Buffett Devotee Can’t Get Enough Bitcoin

5 hour ago